Today, all 50 states have enacted laws allowing for the creation of a relatively new form of business organization, the limited liability company (LLC). The goal of this entity is to operate and be taxed like a partnership but retain limited liability for owners, so an LLC is essentially a hybrid of partnership and corporation. Although states have differing definitions for LLCs, the more important scorekeeper is the Internal Revenue Service (IRS). The IRS will consider an LLC a corporation, thereby subjecting it to double taxation, unless it meets certain specific criteria.

Advantages of S Corporations

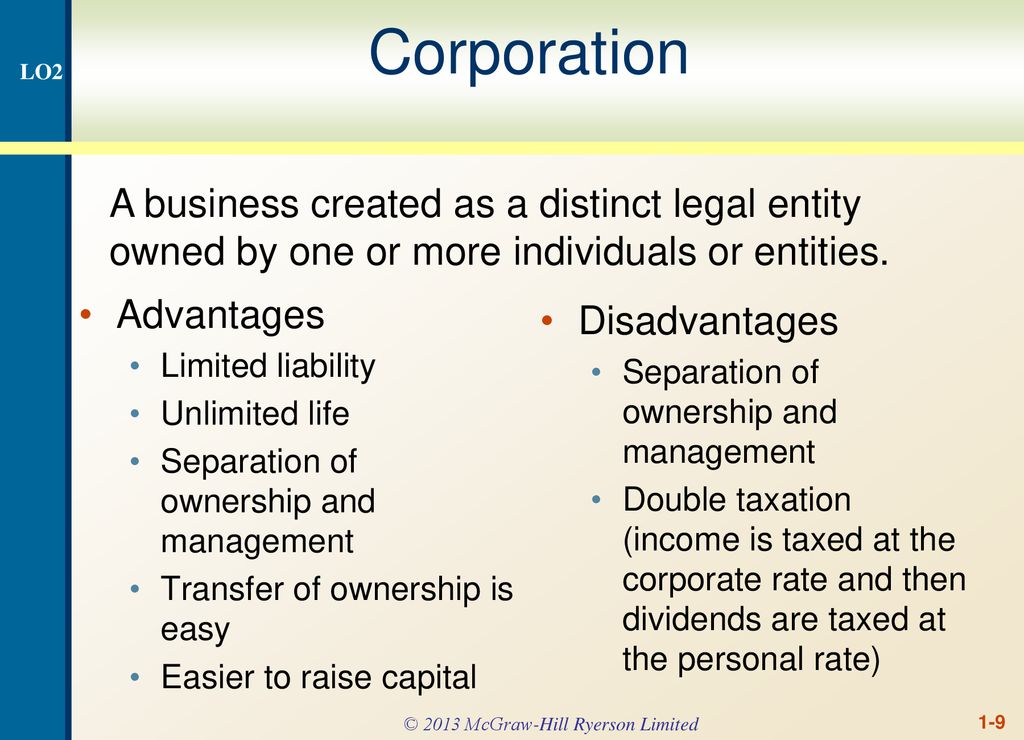

Corporations are generally governed by a board of directors elected by the shareholders. The corporationA business created as a distinct legal entity composed of one or more individuals or entities. Is the most important form (in terms of size) of business organization in the United States. A corporation is a legal “person” separate and distinct from its owners, and it has many of the rights, duties, and privileges of an actual person.

Advantages and Disadvantages of a Corporation: Everything You Need to Know

Even though individual series LLCs are complicated, they are worth exploring with your legal advisor if your company has unique components that could benefit from them. Some employee perks, such as the owner’s medical insurance costs, aren’t directly tax-deductible (only partially as an adjustment to income). The owner may have a difficult time acquiring finances and is frequently forced to rely on personal savings or consumer loans. Profits from the company are credited to the owner’s personal tax return. The simplest and most cost-effective way to structure ownership.

Disadvantages of Taxation for the Entrepreneur

Sole owners have entire control over their businesses and are free to make any decisions they choose within the confines of the law. S corporations combine most of the advantages of C corporations with a better tax structure for the owners. It seems almost unavoidable that governmental regulation must be a part of the corporate scene.

- One of the problems of corporations is that their management is separate from their shareholders.

- Agency problems arise when the objectives of the management do not align with those of the shareholders.

- As an owner, you only pay taxes on the salary or dividends paid to you by the corporation.

- Corporations can enter into contracts and guarantees, lend and borrow money, invest funds, buy, own or sell property, and get into legal disputes as a separate entity.

- A business that takes the effort and money to organize a corporation sends a signal that the company is around to stay.

- If you’re not careful about following these rules, your corporation may lose its good standing, which can result in serious financial and legal consequences.

An “IPO” is the initial public offering of the stock of a corporation. Rules require that such IPOs be accompanied by regulatory registrations and filings, and that potential shareholders be furnished with a prospectus detailing corporate information. Publicly traded corporate entities are subject to a number of continuing regulatory registration and reporting requirements that are aimed at ensuring full and fair disclosure. Their disadvantages are that they may give rise to agency problems, are difficult to form, are subject to stricter rules and regulations, and shareholders are subject to double taxation.

Nonprofits must file even more paperwork because they must apply to the IRS for tax exemption status (minimum $750 to apply). In a few states, nonprofits may also have to file separately for state tax exemption status. Most states also require corporations to file annual documents and/or franchise a disadvantage of the corporate form of organization is tax fees. Nonprofits typically also have to pay fees for registering their charity each year. If you need help with the advantages and disadvantages of a corporation, you can post your legal needs on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site.

For example, in 2006, General Electric Corporation (better known as GE) had about 4 million stockholders and about 10 billion shares outstanding. In such cases, ownership can change continuously without affecting the continuity of the business. The advantages and disadvantages of a partnership are basically the same as those of a proprietorship. Partnerships based on a relatively informal agreement are easy and inexpensive to form. General partners have unlimited liability for partnership debts, and the partnership terminates when a general partner wishes to sell out or dies. All income is taxed as personal income to the partners, and the amount of equity that can be raised is limited to the partners’ combined wealth.

The potential to generate cash is boosted if there are several owners. Whether or whether you need to reinvest profits back into the company.

You must follow your state’s legal requirements to become a corporation. For many businesses, these requirements include creating corporate bylaws and filing articles of incorporation with the secretary of state. Organizing a business in corporate form increases the credibility of the company. Customers, suppliers, and lenders may feel more at ease when dealing with a corporation.

You will likely have to go through extensive paperwork to properly determine and document the details of the organization and its ownership. Corporations are required to file an annual report in many states, for example, and the fee for this report can be $150 or more. Forming a nonprofit corporation is even more difficult because of the increased paperwork.

Corporations can borrow money and own property, can sue and be sued, and can enter into contracts. A corporation can even be a general partner or a limited partner in a partnership, and a corporation can own stock in another corporation. Similarly, even if the existing shareholders cannot provide capital to a corporation, it can issue shares to new shareholders to generate finance.